Introduction

In the vast world of medical billing and coding, CPT Code 99213 stands out as one of the most frequently used codes. It may not be flashy, but its importance cannot be overstated. Used to report outpatient visits for established patients, the 99213 CPT code represents the backbone of daily operations in most clinics, private practices, and outpatient departments.

With evolving documentation requirements, changing payer rules, and updated guidelines from the American Medical Association (AMA) and CMS, understanding this seemingly simple code is critical for compliant billing and optimal reimbursement.

Let’s explore the purpose, criteria, reimbursement, documentation requirements, and comparisons with its related “sister codes” (like 99212 and 99214) to ensure you’re using CPT Code 99213 correctly and confidently.

What is CPT Code 99213?

CPT Code 99213 is defined by the AMA’s CPT (Current Procedural Terminology) Manual as:

“Office or other outpatient visit for the evaluation and management of an established patient, which requires a medically appropriate history and/or examination and low level of medical decision making. The code options will take between 20 and 29 minutes on the day of the encounter.”

This means that the 99213 CPT code applies to non-new patients receiving care in an office or outpatient setting for routine management of health conditions that do not involve high complexity or significant risk.

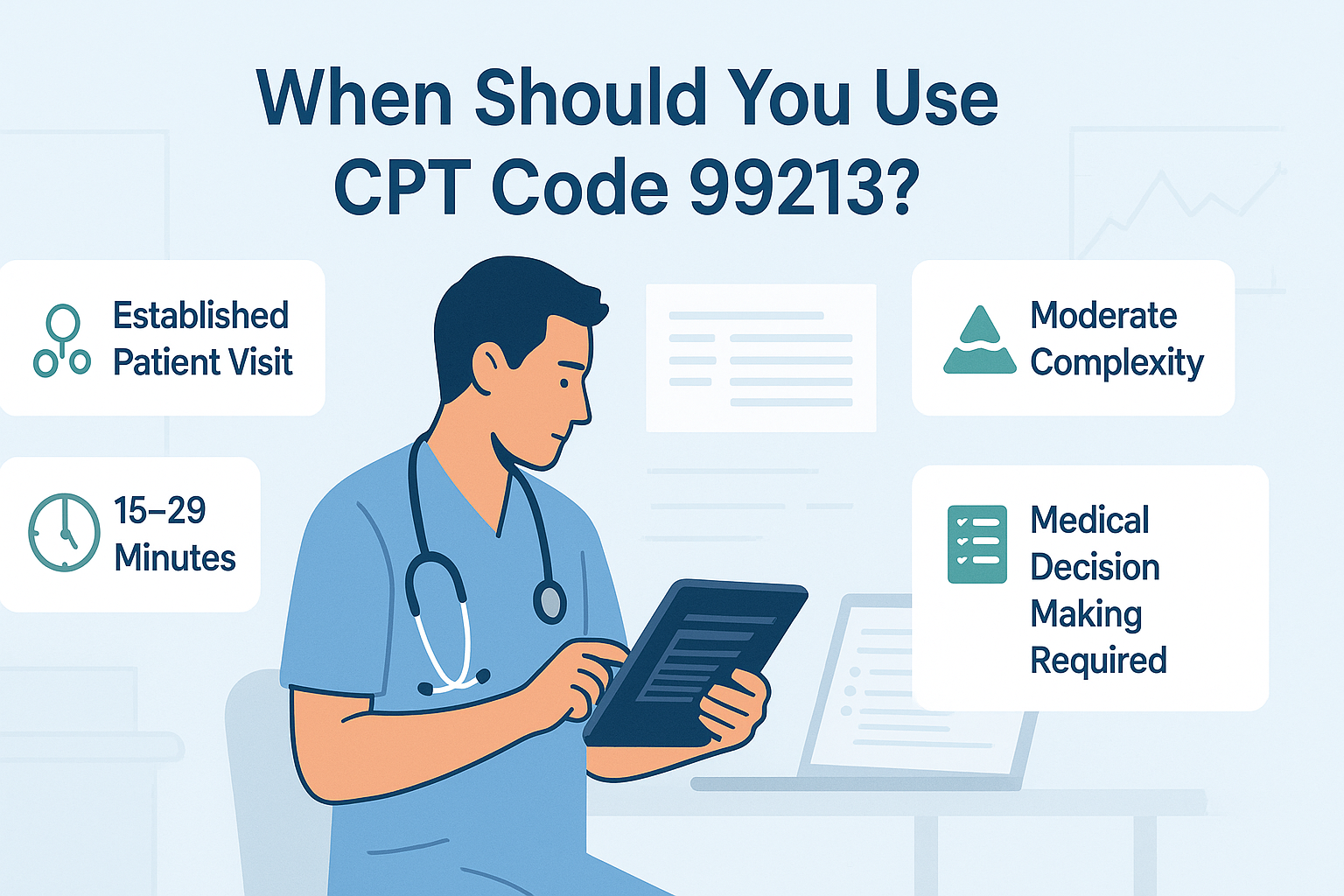

When Should You Use CPT Code 99213?

To use CPT Code 99213 appropriately, the visit must meet one of two pathways:

1. Medical Decision Making (MDM) Criteria

Must involve Low Complexity MDM, which includes:

- One stable chronic illness, or

- An acute uncomplicated illness or injury (e.g., urinary tract infection, sprain)

- Minimal risk of complications or morbidity

2. Time-Based Criteria

If you find that the total time spent on the service day falls between 20 and 29 minutes, you should go ahead and use the 99213 CPT code.

This includes:

- Chart review

- Ordering tests

- Documenting care

- Communicating with the patient (face-to-face or virtual)

Important: Time-based coding must reflect the actual total time a qualified healthcare provider (QHP) spends on that encounter.

Examples of When to Use 99213

- A follow-up visit for a patient with controlled hypertension

- Treatment of a mild skin infection

- Review of lab results with medication management for hypothyroidism

- Counseling a diabetic patient on lifestyle changes without complications

These situations generally require limited review and analysis but still necessitate medical expertise, documentation, and interaction.

Sister Codes: Comparing 99212, 99213, and 99214

Understanding how the 99213 CPT code fits in context helps ensure it is not underused or overused. Here’s a quick comparison:

| Code | Time Range | MDM Level | Example Case |

|---|---|---|---|

| 99212 | 10–19 minutes | Straightforward | Earache, follow-up for resolved sore throat |

| 99213 | 20–29 minutes | Low | Chronic condition under control, minor skin issue |

| 99214 | 30–39 minutes | Moderate | Worsening asthma, multiple medications adjusted |

Using 99213 cpt code for more complex visits (which meet 99214 criteria) can lead to underbilling, while using it for simpler visits (99212) can lead to audits or denials.

2024 Reimbursement Rates for CPT Code 99213

In 2024, Medicare usually pays about $90.88 for CPT Code 99213.

However, this amount may vary depending on:

- Geographic location (adjusted by locality)

- Payer (Medicare vs. private insurers)

- Modifiers used

- Place of service (telehealth, in-person)

Pro Tip: Check your local Medicare Administrative Contractor (MAC) or payer fee schedule for precise rates.

Common Mistakes to Avoid with CPT Code 99213

- Under-documentation

Failing to include enough clinical information to support the chosen level of service can result in downcoding or claim denials. - Incorrect Time Attribution

Providers often confuse time spent before or after the visit with billable time. The date of the meeting is just one thing that actually matters. - Using CPT Code 99213 for New Patients

This code is only valid for established patients. Use 99203 or 99204 for new patients depending on complexity or time.

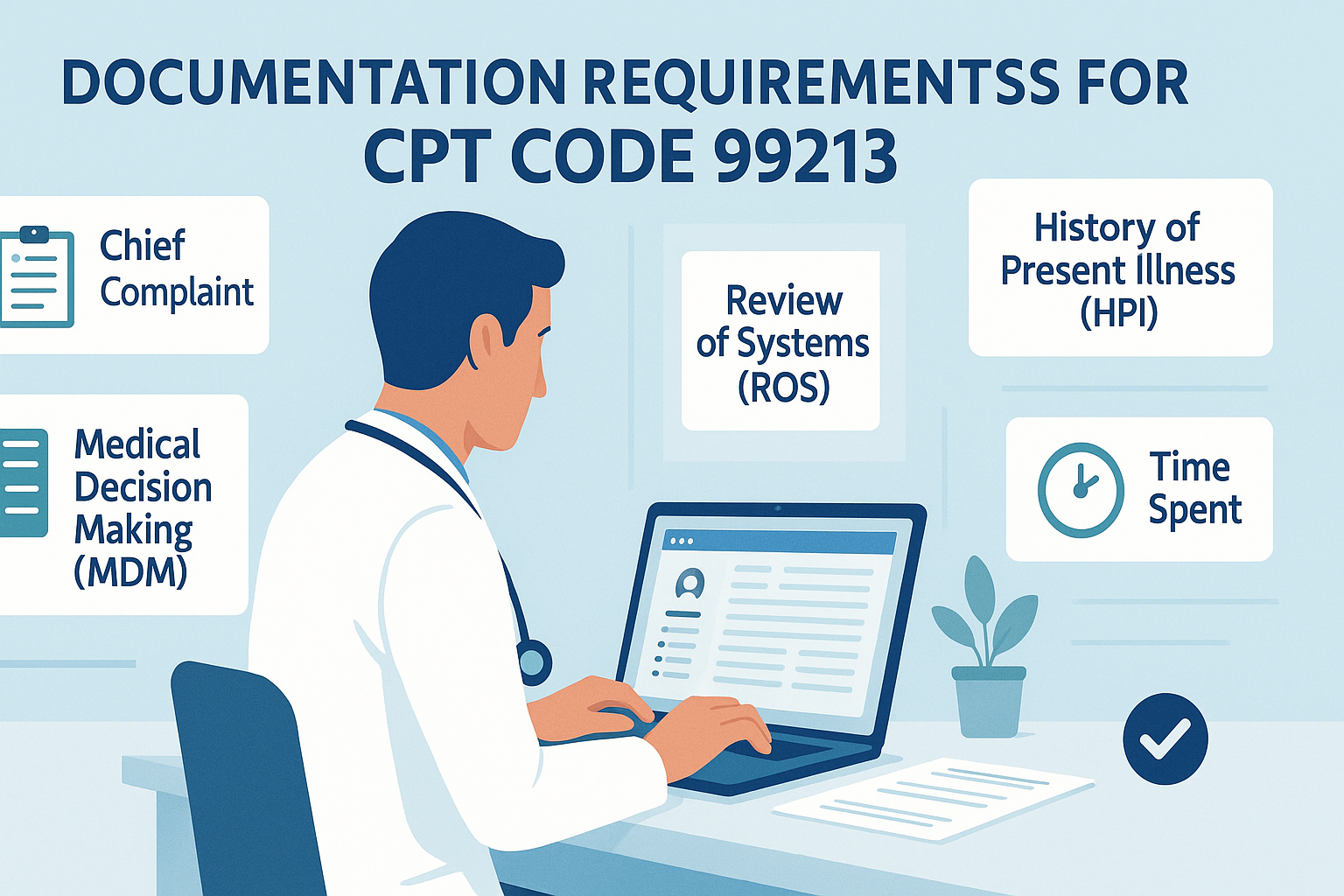

Documentation Requirements for CPT Code 99213

To avoid audits and justify the code, you should document:

History

- Chief complaint

- Relevant History of Present Illness (HPI)

- Review of Systems (ROS) and Previous Medical History (if applicable)

Examination

- Focused physical exam appropriate for the condition

Medical Decision Making

- Number and type of problems addressed

- Data reviewed (labs, imaging)

- Risk of complications or morbidity

Total Time

If coding based on time: clearly state:

Total time spent on the date of encounter: 25 minutes

And include components such as:

- Reviewing the patient’s chart

- Documenting clinical notes

- Ordering and reviewing test results

- Counseling the patient on condition or treatment

- Coordinating care with other providers (if applicable)

Use of Modifiers with CPT Code 99213

Depending on the scenario, you might need to append modifiers to this code:

- Modifier 25: When a significant, separately identifiable E/M service is performed on the same day as a procedure.

- Modifier 95: For telehealth services delivered in real-time interactive audio-video format.

- Modifier 24: For an unrelated E/M service during the postoperative period.

CPT Code 99213 in Wound Care and Specialty Practices

In wound care, dermatology, podiatry, and pain management, the 99213 CPT code is frequently used for ongoing care where the patient’s condition is stable or improving.

Example:

A patient returns for follow-up after a debridement procedure. If the visit includes review of progress, evaluation of wound healing, and ongoing management without new complexities, CPT Code 99213 is likely appropriate.

Always assess whether the work done on that visit qualifies as “low complexity.” If a new complication is addressed, you might need to code higher.

CPT Code 99213 and Telehealth

Post-pandemic regulations have expanded the use of CPT Code 99213 for telemedicine, including video visits.

Telehealth visits billed under CPT Code 99213 must still meet the MDM or time criteria.

- Use Modifier 95 to designate it as telehealth.

- Be sure to include proper documentation of patient consent and the telehealth platform used.

Audit-Proofing Your CPT Code 99213 Claims

To minimize audit risk and ensure compliance:

- Keep documentation consistent with either:

- Time: Include start and end time or total time plus activities.

- MDM: Clearly outline the problems assessed, data reviewed, and risk.

- Use templates wisely:

While EHR templates can help, over-reliance can result in cloned or vague notes that auditors flag. - Educate your staff:

Billers and coders should be trained on the latest E/M guidelines to catch documentation gaps before claims are submitted.

Frequently Asked Questions (FAQs) About CPT Code 99213

Q1. Can I use CPT Code 99213 for a new patient visit?

No. CPT Code 99213 is exclusively for established patients. For new patients, use codes 99202–99205, depending on complexity or time.

Q2. What does “low level of medical decision making” mean?

It refers to addressing one or more stable chronic conditions or an acute, uncomplicated illness. There is limited data review, and the risk of complications is minimal.

Q3. How much does Medicare pay for CPT Code 99213?

In 2024, the national average Medicare reimbursement is approximately $90.88, but this may vary depending on location and payer.

Q4. Can I bill CPT Code 99213 and a procedure code on the same day?

Yes, but you must append Modifier 25 to indicate that the E/M service was separately identifiable and significant from the procedure performed.

Q5. Is CPT Code 99213 applicable for telehealth consultations?

Yes. If the telehealth visit meets the criteria for time or medical decision making, and documentation supports it, you can use CPT Code 99213 with Modifier 95.

Q6. What is counted for 20–29 minutes for CPT Code 99213?

Only the supplier’s time at the date of the meeting, which includes face-to-face and non-face-to-face tasks (such as map reviews, documentation, consultation, etc.).

Q7. What are common denial reasons for CPT Code 99213?

- Insufficient documentation

- Used for new patient visits

- No modifier when required

- Inappropriate MDM or time level for complexity of visit

Conclusion

CPT Code 99213 may seem routine, but it’s anything but insignificant. As the “workhorse” of outpatient medical billing, it’s essential to get it right—for your patients, your practice, and your revenue cycle. By understanding its proper use, documentation standards, and how it compares to adjacent codes, you’ll not only stay compliant but also maximize appropriate reimbursement.